top of page

Looking Back With Gratitude

As the year comes to a close, our team has been reflecting on moments that remind us how valuable perspective, resilience, and steady progress really are. This photo was taken this year of Lara at the top of a via ferrata (Italian for “Iron Path”) climb in the Dolomites, one of those rare pauses to look back at how far you’ve come and forward to what’s ahead. We are deeply grateful to our clients and referral partners for the trust you place in us and for allowing us to suppo

Big Increase in 2026 Federal Estate Exemption: What the New IRS Adjustments Mean for You

The IRS has released its 2026 inflation adjustments, and they bring notable changes across the federal tax landscape. These updates affect everything from the estate and gift tax exemption to income tax brackets and standard deductions. For individuals and families focused on long-term wealth transfer, the implications are especially significant. Understanding the 2026 Estate and Gift Tax Exemption The most substantial update for 2026 is the increase in the federal estate and

New York LLC Transparency Act: What to Know Before January 1, 2026

Dear Clients and Colleagues, It is important to note that new reporting rules for New York LLCs take effect in 2026. Below is what business and entity owners should know to stay compliant and avoid costly penalties. Beginning January 1, 2026, the New York LLC Transparency Act (NYLTA) will take effect, introducing new reporting requirements for limited liability companies doing business in New York. The Act aims to enhance ownership transparency but will also create new compli

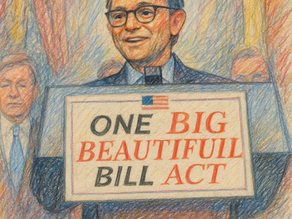

QSBS Changes Under the One Big Beautiful Bill Act

The One Big Beautiful Bill Act (OBBBA) , signed into law on July 4, 2025 , marks the most significant reform of Qualified Small Business...

The Big Beautiful Bill Has Passed — What It Means for You and Why Estate Planning Still Matters More Than Ever

On July 4th, President Trump signed into law what is now officially known as the “One Big Beautiful Bill Act” (OBBBA). This sweeping...

Proposed Estate Tax Reform: What the “One Big Beautiful Bill Act” Could Mean for Your Estate Plan

A new tax proposal backed by President Trump—informally referred to as the One Big Beautiful Bill Act —has introduced significant...

Important Update: Major Federal Estate Tax Proposals Could Radically Alter Planning Strategies

Dear Clients, Colleagues and Trusted Advisors, There have been several noteworthy estate and gift tax proposals recently introduced in...

Treasury Department Suspends Enforcement of Corporate Transparency Act: What This Means for U.S. Businesses

On March 2, 2025, the U.S. Department of the Treasury announced that it is suspending enforcement of penalties and fines related to the...

Important Update on the Corporate Transparency Act (CTA) - Reporting Deadlines

The Corporate Transparency Act (CTA) is back in effect and business owners should be aware of the latest reporting requirements to ensure...

bottom of page